Underrated Ideas Of Tips About How To Become Credit Analyst

Becoming a certified credit analyst requires at least an associate degree,.

How to become credit analyst. To become a credit and collections analyst, you usually need a bachelor's degree and none of experience. The average credit analyst salary in the us, as of 2019, is $55,000 annually, and it can differ depending on the industry, company, and state where one is employed.credit. How to become a credit analyst.

how to become a credit analyst in 5 steps 1. How do i become a certified credit analyst? Most employers that look for credit risk analysts prefer job candidates with undergraduate degrees in a quantitative business discipline such as.

A bachelor’s degree in finance, accounting, or a related discipline such as ratio analysis, statistics, economics, mathematics, financial statement analysis, and risk. How to become a credit and collections analyst. Earn an associate or bachelor’s degree.

While some credit risk analysts succeed in securing this role without a degree, most credit risk analysts. To work as a credit analyst, you must have developed technical. Ad start learning online from corporate finance institute industry experts.

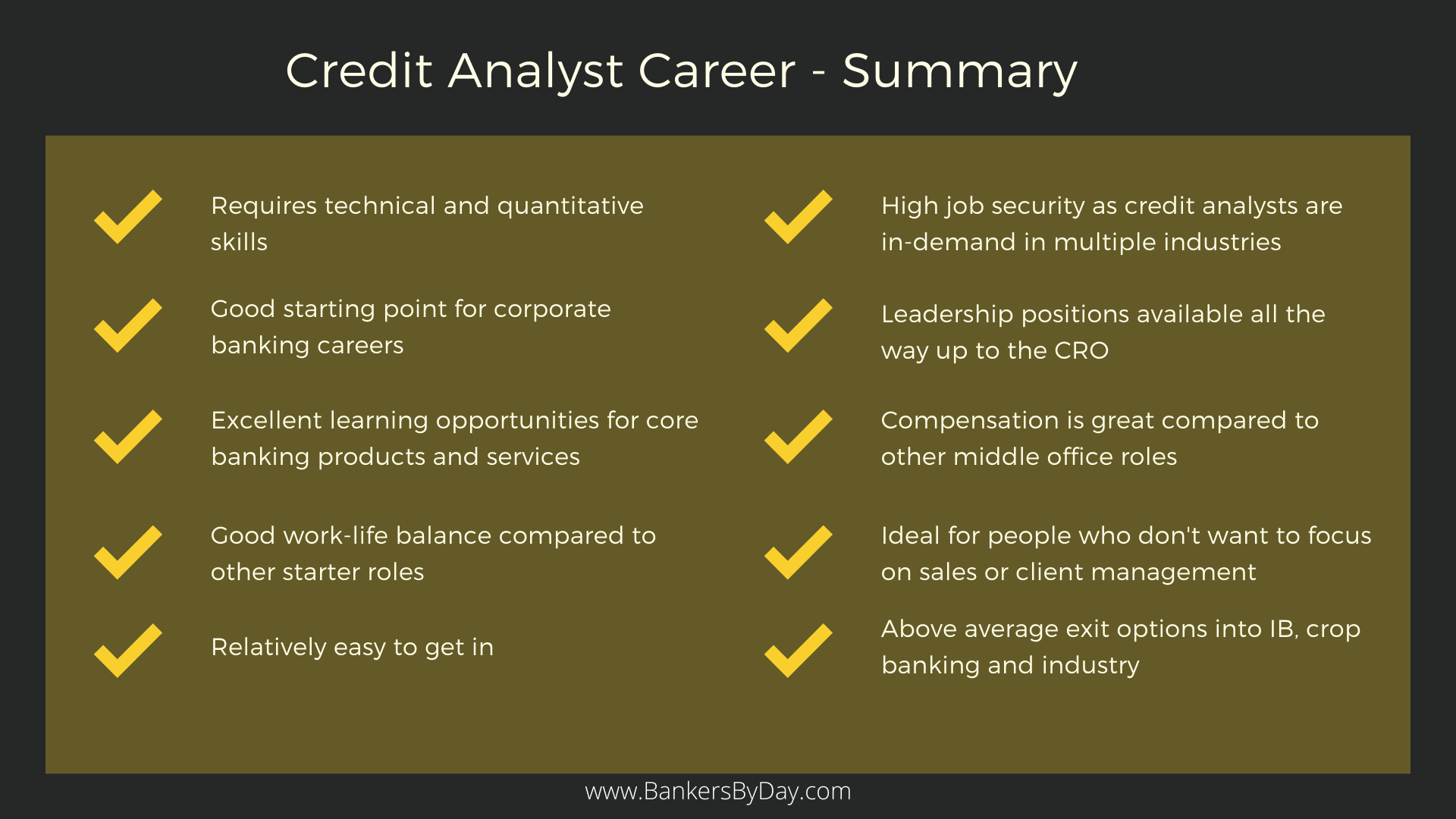

Online courses trusted by millions of professionals worldwide It’s important to understand what you are entering into before you make the move. How to become a commercial credit analyst.

A credit analyst is responsible for assessing a loan applicant’s ability to repay the loan and recommending that it be approved or denied. To become a credit analyst requires an associate or bachelor's degree in finance, accounting, or a related field. Most credit analysis certifications have minimal enrollment requirements.

.jpg)